Comprehensive Accounting Service

Comprehensive Accounting Service

Ensuring your financial health requires consistent attention. We provide you with strategic guidance to help you navigate any changes your growing business faces throughout the year. Your business can have seamless administration for all of your bookkeeping needs. Providing more freedom as well as control over your business finances. Easy Month to Month Contracts.

We gladly do ALL of the heavy lifting for any size business. ANCUR provides seamless Payroll and Bookkeeping Services for ANY Budget with the Personal touch for which ANCUR is widely known.

Comprehensive Accounting Service

Full-Service Bookkeeping, Strategic Advising, Monthly Financial Reporting, Quarterly Financial Reviews, Annual Income Tax Preparation. Tax Planning.

INDIVIDUAL TAX RETURNS OPT-IN $1 Million Tax Audit Defense™

With Protection Plus, you have an entire tax audit defense department you can rely on. If you receive tax notices, audits, or inquiries, we provide up to $1,000,000 in services to reach a resolution. That includes a Professional Case Assessment, a professionally prepared response to the taxing authority, and representation before the IRS or State.

INCOME TAX REFUNDS: FAST CASH ADVANCE LOANS VIA GO2BANK $500 TO $7,000

Professional Software Management

QuickBooks Online  Gusto

Gusto

ANCUR’s accounting is unique in that its focus is capturing the most money DURING the year instead of at the END of the year during the “dreaded tax season.” We use best in practice cost accounting methods, such as Lean Accounting, to clearly define a business’ finances and generate financial reports to Management. Spot on Financial reporting provides management with immediate ways to SAVE money, improve operations of the business, provide finance opportunities, and tax strategies.

We take the guess work out of Payroll and Bookkeeping Services

-

- Dedicated Online Client Portal for 24/7 access to Accounting Management and Data storage

-

- Dedicated Accounting Manager

-

- Business Vertical Financial Analysis

-

- Detailed Cost and Budget Accounting methods provide business owners with immediate insights on key financial areas such as profit or loss to reach greater stability and growth for their businesses.

-

- Business Vertical Financial Analysis

-

- Quarterly Financial Reviews

-

- Financial Health Score Cards are reviews of each quarter of a business providing spot on assessment of financial measures ranging from operational efficiency to the liquidity of a business. These metrics are essential to management and ensure a proactive stance in the diagnosis of the health of a company before it becomes too big, and possibly disastrous, by year’s end.

-

- Quarterly Financial Reviews

-

- Corporate Tax Returns

-

- Personal Tax Returns

-

- Monthly State Sales and Use tax filings

-

- Annual Tax Compliance Reporting

-

- Franchise & Excise tax

-

- Business Tax

-

- County Tax

-

- Annual Tax Compliance Reporting

-

- Corporate Financial Assessments

-

- Accounting Systems Setup

-

- Employer Identification Numbers (EIN) for Companies Filing and Registration

-

- Payee Tax Identification Numbers (PTIN) filings and registration

-

- State Employer Account Filing and Registration

-

- Business Tax Credits- Employee Retention Tax Credit

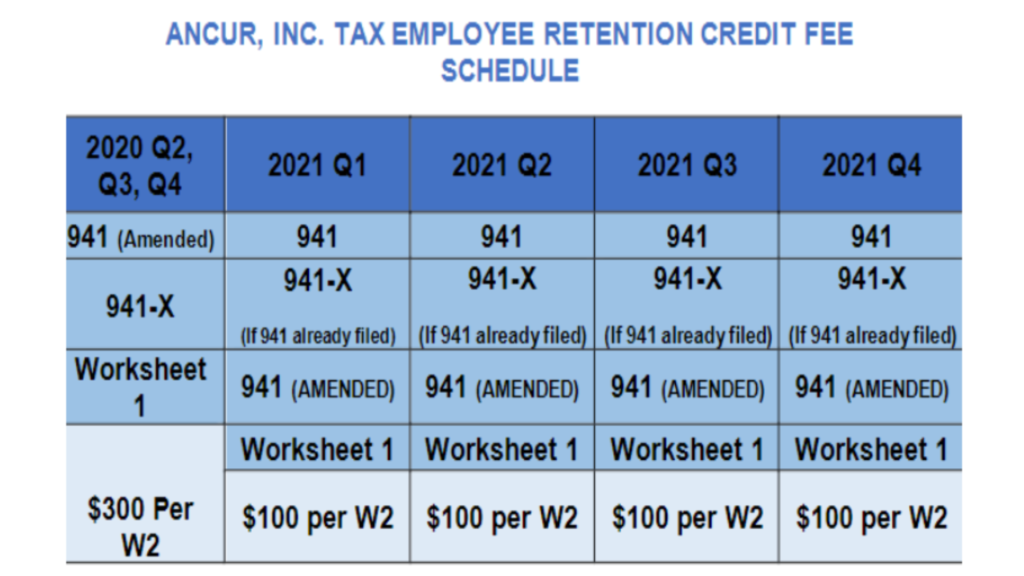

EMPLOYEE RETENTION TAX CREDIT (ERTC)

ANCUR, INC can assist with ERTC (EMPLOYEE RETENTION TAX CREDIT) benefits.

Your company is eligible if in 2020 you had quarters that experienced losses of at least 50% relative to the same quarters in 2019.

-

- For example, if your company had gross receipts of $1000 in Q2 2019, then made $500 or less in Q2 2020, it would be eligible to start claiming ERTC’s on wages paid starting Q2 2020.

The Employee Retention Tax Credit is a fully refundable tax credit for employers equal to 50 percent of qualified wages (including allocable qualified health plan expenses) that Eligible Employers pay their employees for all 2020 and 70 percent of qualified wages (including allocable qualified health plan expenses) that Eligible Employers pay to each of their employees.

-

- This Employee Retention Credit applies to qualified wages paid after March 12, 2020, and before December 31, 2021.

-

- The maximum amount of qualified wages considered with respect to each employee for all calendar quarters in 2020 is $10,000, so that the maximum credit for an Eligible Employer for qualified wages paid to any employee is $5,000 and for each calendar quarter in 2021 is $10,000, so that the maximum credit for an Eligible Employer for qualifies wages paid to any employee is $7,000. The total eligible per employee for all periods is $33,000.

Refunds are processed for around 6 – 8 months due to IRS (Internal Revenue Service) processing speeds.

Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses.

QBO PROADVISOR ELITE TRAINING: ANCUR IS A PROUD QBO PROADVISOR ELITE PROGRAM MEMBER. QBO BOOKKEEPING TRAINING VIA ANCUR IS A NEW CAREER OPTION. NEXT-LEVEL BOOKKEEPING TRAINING. Coupled with on-the-job training our joint program produces a stronger business or your next business opportunity. Contact Pradeep Khadka at bizadmin@ancur.biz for more information.

ANCUR IS A PROUD QBO PROADVISOR ELITE PROGRAM MEMBER. QBO BOOKKEEPING TRAINING VIA ANCUR IS A NEW CAREER OPTION. NEXT-LEVEL BOOKKEEPING TRAINING. Coupled with on-the-job training our joint program produces a stronger business or your next business opportunity. Contact Pradeep Khadka at bizadmin@ancur.biz for more information.